Foreign exchange, also known as forex or FX, is the exchange of different currencies on a decentralized global market. It’s one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world’s currencies on this market.

At Basel Markets you have the opportunity to trade CFDs with leverage. Leverage trading enables you to open large deals with a relatively small investment, thus maximizing your trading power, but also your risk. Why? Because when you use high leverage, both successful and unsuccessful deals are, in simple terms, amplified.

Here’s an example: Let’s say you invest $100 in a popular currency pair: GBP/USD. With a maximum leverage of 400:1, you can open a deal that is worth 400 times your initial investment, which is $40,000.

This means that for every $1 you invest, we give you $400 in trading power.

These Exchange rates are fluctuated based on which currency is stronger at the moment and creates an opportunity for traders to gain profit.

In foreign currency trading, currencies are quoted in pairs. When you see a currency pair, the first currency is called the base currency and the second currency is the quote currency or counter currency. For instance, say the EUR/AUD is trading at 1.6163. This means to buy 1 unit of Euro, you will need $1.6163 Australian dollars.

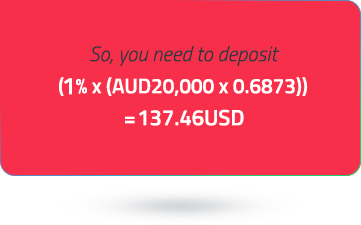

You decide to buy AUD 20,000 worth of USD because you think that the AUD/USD price will rise in the future. Your account leverage is set to 100:1. This means that you need to deposit 1% of the total position value into your margin account.

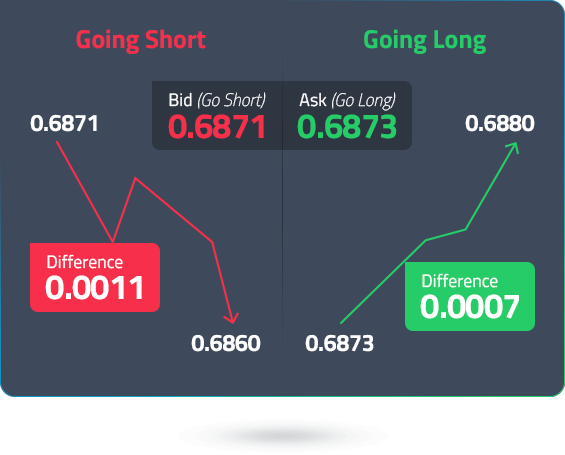

Now, in the next hour, if the price moves to 0.6880/0.6882, you have a winning trade. You could close your position by selling at the current price of USD 0.6880.

If the price of AUD/USD | To | You Could Gain or Lose (for a long position) | Resulting in a Return of the Initial Margin |

|---|---|---|---|

Rises by 10% | 0.75603/0.75606 | 0.75603/0.75606 | 1000% |

Rises by 5% | 0.72167/ 0.72169 | USD 687.4 | 500% |

Declines by 10% | 0.61857/0.61859 | USD -1374.6 | -500% |

Declines by 5% | 0.65293/0.65297 | USD -687.4 | -1000% |

When you assume a long position in a currency pair, you buy a currency in the hopes that its price will rise (appreciate) in the future. This means you wish to buy the base currency and sell the quote currency, since you expect the base currency to appreciate with respect to the quote currency.

When you assume a short position in a currency pair, you sell the base currency, expecting it to depreciate (decline in price) in the future, allowing you to buy it at a later date but at a lower price.

When you decide on your position size, a term you will hear is “lot.” Lots are standardized position sizes for currencies. The foreign exchange market gives you the flexibility to trade according to your means and risk profile. The standard size for a lot is 100,000 units of the base currency. There also are mini, micro and nano lot sizes that contain 10,000; 1,000 and 100 units of the base currency, respectively.

From the analysis standpoint, both fundamental and technical analysis provide their unique advantages and drawbacks.

Currency values fluctuate according to a nation’s perceived economic health. Fundamental analysis is the study of all factors that impact a country’s economy and is also representative of its future trends. When investors perceive a particular economy as being more rewarding than others, demand for the domestic currency increases, driving up its price. Fundamental traders look out for these indicators to gauge the economic health of a country.

Monetary Policy: The interest rates decided by a country’s central bank directly impact the domestic currency. When the interest rate increases, currency value tends to appreciate and vice versa.

Inflation Rate: Central banks are responsible for keeping inflation in check and promoting employment. To do so, they have various tools available, including the nation’s monetary policy, market interventions and quantitative easing.

Balance of Trade: The balance between a country’s exports and imports can impact currency values.

GDP Growth: The overall health of an economy is denoted by its GDP growth. Currency values tend to appreciate with a favorable GDP growth rate.

There are several other economic indicators, like employment rate, retail sales, manufacturing index and housing market data, that impact the forex market. To keep track of the economic releases, traders use an economic calendar. This is because significant volatility tends to ensue on the days that important reports are released. Based on whether the actual figures meet or beat market consensus, currency prices can go up or down.

Technical analysis is based on the principle that the markets tend to repeat their historical price trends. To discover these trends, traders rely on technical indicators and forex chart analysis. Technical indicators are statistical formulae that can provide important information about the market. They are categorized into:

Trend: Such as Simple Average, Trend lines, Moving Average Convergence Divergence (MACD)

Volume: Such as On Balance Volume (OBV), Chaikin Money Flow

Momentum: Such as Stochastic Oscillators, Relative Strength Index (RSI)

Volatility: Such as Average True Range (ATR), Volatility Index (VIX)

Forex trading platforms like MetaTrader 4 and MetaTrader 5 come with pre-installed technical indicators, allowing you to analyse the ongoing trends and any chances of price reversals. Based on these indicators, you can create forex trading strategies.

These platforms also allow you to use a combination of both fundamental and technical analysis. While fundamental analysis, through financial news alerts, allows traders to gauge the interest rate and inflation outlook for both currencies in a pair, technical indicators and charts provide insight into trends and ranges within the price history. Chart patterns can provide clues regarding how prices might move within the patterns and where they are likely to go after a break-out.

* Winner of ‘Best Global International Finance Value Broker’ at the Global Institutional Investors Forum 2017, 2018, 2019 & 2020

** Data acquired from our server shows our EURUSD spread to be 0.0 pips on average 35.89% of the time from 01-12-2020 to 31-12-2020 (available for our RAW Spread trading accounts only).

* The average order execution time between the trade being received, processed and confirmed as executed by us is 38 milliseconds. As observed from our bridge provider between 01-12-2020 to 31-12-2020. Basel Markets was rated by Investment Trends as the Best for Quality of Trade Execution 2018, 2019 and 2020.

Trade Responsibly: Equity-linked and foreign exchange derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. Basel Markets is a company registered as Basel Markets International Limited, a globally regulated provider of CFD and foreign exchange trading services and Basel Markets which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 26170 BC 2021. Basel Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Basel Markets does not accept clients from certain countries/regions including the United States and Hong Kong. For a full list of restricted countries, please contact our Client Service for further details.